child tax credit 2021 amount

A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive. If you have any questions about your unique circumstances you should visit irsgovchildtaxcredit2021.

Child Tax Credit 2021 What S Changed Multop Financial

The first phaseout reduces the Child Tax Credit by 50 for each 1000 or fraction thereof by which the taxpayers modified AGI exceeds the income amounts above.

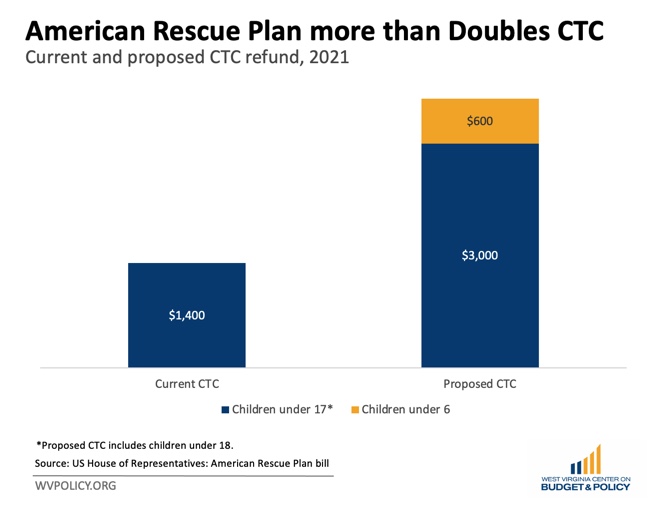

. The American Rescue Plan raised the maximum Child Tax Credit in 2021 to 3600 for qualifying children under the age of 6 and to 3000 per child for qualifying children ages 6. The amount changes to 3000 total for each child ages six through 17 or 250 per. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim.

IR-2021-153 July 15 2021 The Internal Revenue Service and the Treasury Department announced today that millions of American families have started receiving monthly Child Tax Credit payments as direct deposits begin posting in. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual. If we had not processed your 2020 tax return when we determined the amount of your advance Child Tax Credit payment for any month starting July 2021 we estimated the.

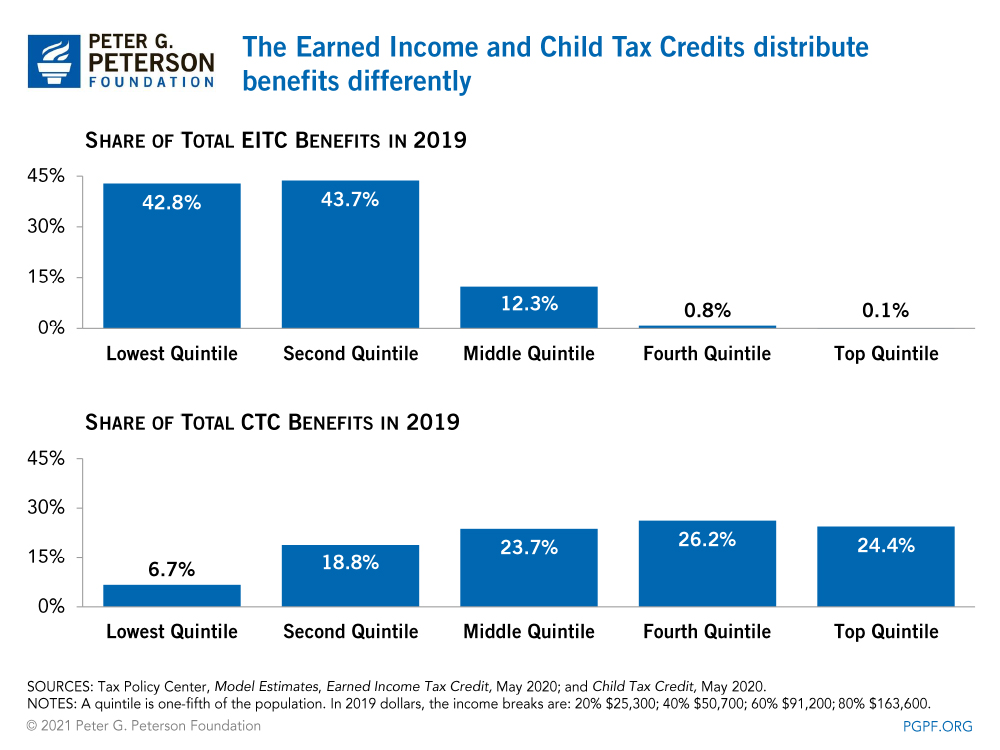

The American Rescue Plan Act ARPA of 2021 made important changes to the Child Tax Credit CTC for tax year 2021 only. The credit amounts will increase for many. The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per qualifying.

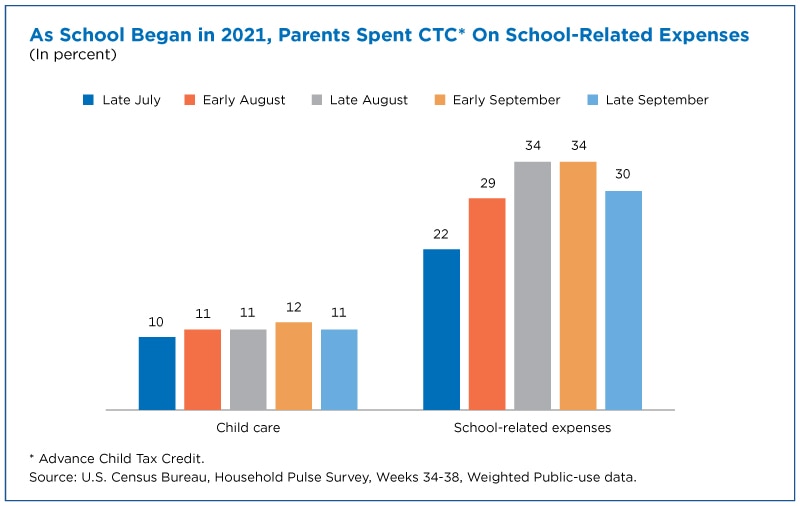

Yes if your 2021 income is high enough the amount of Child Tax Credit you can claim will be reduced. Your amount changes based on the age of your. Families will be eligible to claim any Child Tax Credit amount they are eligible for over the amount of any monthly Child Tax Credit payments received last year when they file their 2021 tax return during the 2022 tax filing season.

New 2021 Child Tax Credit and advance payment details. To reconcile advance payments on. Have been a US.

Where to enter Letter 6419 in 2021 TaxSlayer Pro. The number of qualifying children properly taken into account in determining the allowed Child Tax Credit amount on your 2021 tax return. In the Child Tax Credit Menu select.

The amount of your Child Tax Credit will not be reduced if your 2021. The credit amount was increased for 2021. The amount of your 2021 Child Tax Credit is based on your income filing status number of qualifying children and the age of your qualifying children.

Child Tax Credit amounts will be different for each family. Because of the COVID-19 pandemic the CTC was expanded under the American Rescue Plan of 2021. If you did not file a tax return for 2019 or 2020 you likely did not receive monthly Child Tax Credit payments in 2021.

A childs age determines the amount. For 2021 eligible parents or guardians. The American Rescue Plan increased the amount of the Child Tax Credit from 2000 to 3600 for qualifying children under age 6 and 3000 for.

The American Rescue Plan increased the Child Tax Credit from 2000 per child to 3000 per child for children over the age of six and from 2000 to 3600 for children under the age of. These people are eligible for the. The IRS pre-paid half the total credit amount in monthly payments from.

This was because the government did not know how many qualifying. The 2021 Earned Income Tax Credit provides a tax break for low-income workers and families based on their wages salaries tips and other pay as well as earnings from self-employment. You properly claimed three.

That comes out to 300 per month through the end of 2021 and 1800 at tax time next year. During the process of creating the return you are prompted to enter the amounts from Letter s 6419.

Check Advance Child Tax Credit Economic Impact Payments On 2021 Tax Returns

Nearly A Third Of Parents Spent Child Tax Credit On School Expenses

How The New Expanded Federal Child Tax Credit Will Work

Information From The Internal Revenue Service Heads Up About Advance Child Tax Credit Payments Hartford Public Schools

Child Tax Credit 2021 What To Know About New Advance Payments

Everything You Need To Know About The 2021 Child Tax Credit Storyline Financial Planning Christian Financial Advice

The 2021 Child Tax Credit John Hancock Investment Mgmt

The American Families Plan Too Many Tax Credits For Children

Child Tax Credit Don T Throw Away This Letter Before Filing Taxes Wkrc

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Child Tax Credit Irs Letter 6419 What To Know About Advance Payments

Child Tax Credit Irs Letter 6419 What To Know About Advance Payments

Advance Child Tax Credit Short Or Missing Navigate Housing

Child Tax Credit 2021 8 Things You Need To Know District Capital

Child Tax Credit Schedule 8812 H R Block

Claim Advance Child Tax Credit On 2021 Return Filing King5 Com

2021 Child Tax Credit Do You Qualify For The Full 3 600 Wcnc Com